Some Ideas on Personal Loans Canada You Need To Know

Some Ideas on Personal Loans Canada You Need To Know

Blog Article

Personal Loans Canada Can Be Fun For Everyone

Table of ContentsPersonal Loans Canada Fundamentals ExplainedWhat Does Personal Loans Canada Mean?10 Simple Techniques For Personal Loans CanadaThe Main Principles Of Personal Loans Canada Rumored Buzz on Personal Loans Canada

Doing a normal spending plan will give you the self-confidence you require to manage your money successfully. Excellent things come to those that wait.Saving up for the huge points indicates you're not going right into debt for them. And you aren't paying much more in the lengthy run due to all that rate of interest. Trust fund us, you'll appreciate that family cruise or play ground set for the youngsters way more recognizing it's currently paid for (rather of making repayments on them up until they're off to university).

Absolutely nothing beats tranquility of mind (without debt of program)! You don't have to transform to individual lendings and debt when things obtain tight. You can be complimentary of financial obligation and begin making genuine grip with your money.

They can be protected (where you offer up security) or unprotected. At Springtime Financial, you can be authorized to borrow cash up to loan quantities of $35,000. An individual financing is not a line of credit history, as in, it is not rotating financing (Personal Loans Canada). When you're accepted for a personal finance, your loan provider offers you the total simultaneously and afterwards, usually, within a month, you begin repayment.

Some Known Factual Statements About Personal Loans Canada

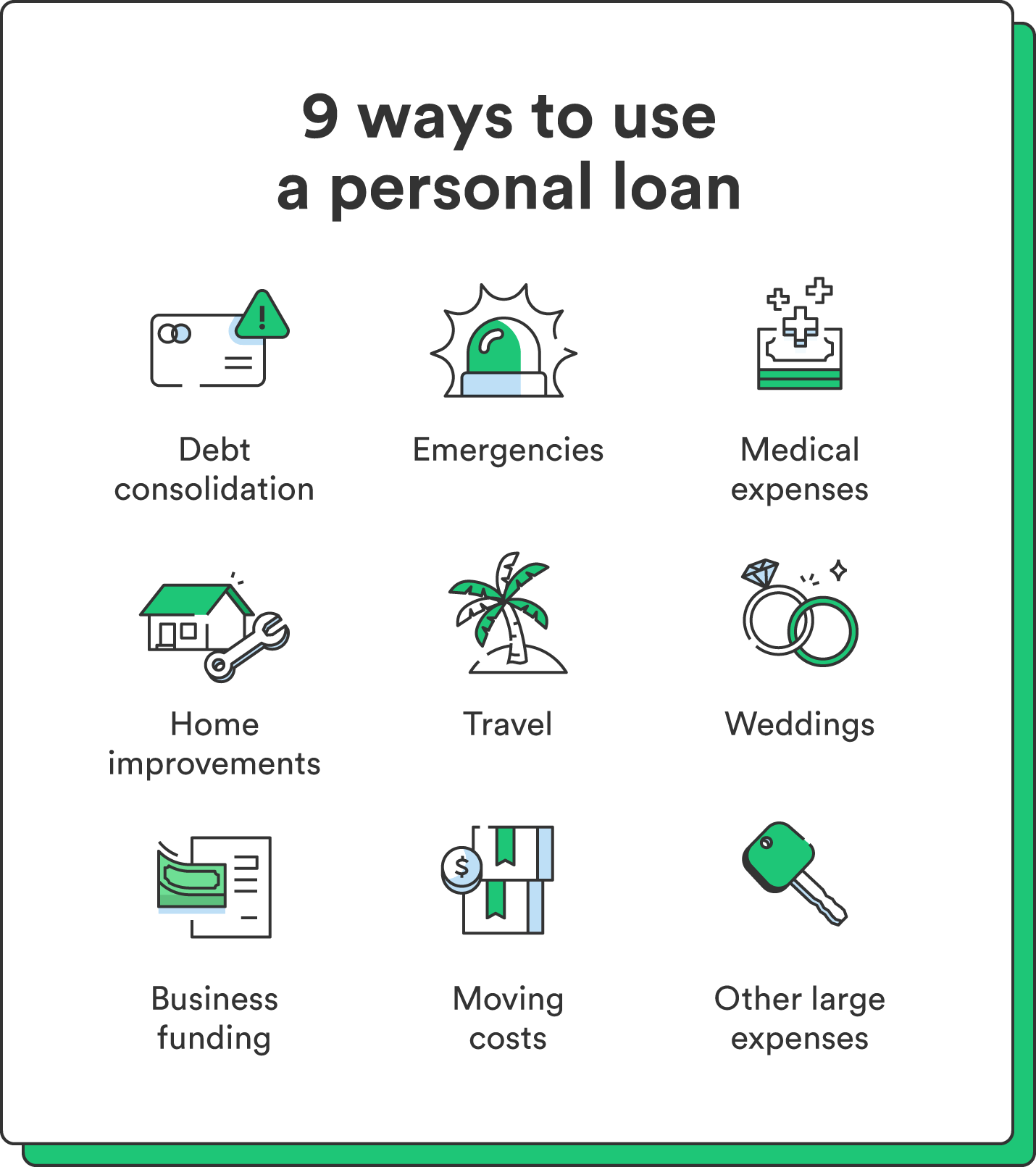

A typical factor is to consolidate and merge financial debt and pay every one of them off at the same time with a personal loan. Some financial institutions placed terms on what you can utilize the funds for, however numerous do not (they'll still ask on the application). home enhancement finances and restoration loans, fundings for moving expenses, vacation loans, wedding celebration financings, medical financings, cars and truck repair loans, fundings for lease, little auto loan, funeral finances, or various other costs settlements as a whole.

The demand for personal lendings is climbing amongst Canadians interested in running away the cycle of cash advance financings, settling their debt, and rebuilding their credit rating score. If you're applying for an individual lending, right here are some things you must keep in mind.

The smart Trick of Personal Loans Canada That Nobody is Talking About

Furthermore, you may be able to minimize just how much complete rate of interest you pay, which indicates even more cash can be saved. Personal car loans are effective devices for developing your credit rating. Payment history represent 35% of your credit history, so the longer you make routine repayments promptly the more you will see your rating rise.

Personal loans offer a great possibility for you to rebuild your credit rating and repay financial obligation, however if you do not spending plan correctly, you might dig yourself right into an also deeper opening. Missing out on one of your regular monthly settlements can have an unfavorable impact on your credit history however missing numerous can be ravaging.

Be prepared to make each and every single payment in a timely manner. It's real that a personal funding can be utilized for anything and it's simpler to get authorized than it ever before was in the past. However if you don't have an urgent need get redirected here the added money, it may not be the very best option for you.

The fixed regular monthly repayment quantity on a personal loan relies on just how much you're borrowing, the rates of interest, and the fixed term. Personal Loans Canada. Your interest rate will depend upon aspects like your credit report and revenue. Frequently times, individual financing rates are a great deal reduced than bank card, however often they can be higher

Personal Loans Canada for Dummies

The marketplace is wonderful for online-only loan providers lending institutions in Canada. Perks include find out here wonderful rate of interest, incredibly fast processing and funding times & the privacy you may want. Not every person likes strolling into a financial institution to request money, so if this is a difficult spot for you, or you simply do not have time, checking out on the internet loan providers like Springtime is a wonderful choice.

That mostly depends upon your ability to repay the quantity & pros and disadvantages exist for both. Repayment lengths for individual car loans normally fall within 9, 12, 24, 36, 48, or 60 months. Often longer payment periods are an option, though uncommon. Much shorter repayment times have really high monthly this post settlements but then it's over quickly and you do not lose more cash to interest.

See This Report on Personal Loans Canada

You could obtain a reduced rate of interest rate if you fund the lending over a much shorter duration. A personal term financing comes with an agreed upon payment timetable and a taken care of or floating interest price.

Report this page